All Prize issues are paid to your member’s membership within this ten weeks following end from their/the woman stand. You get a damage tolerance of 5 x your Constitution modifier. In the 6th top your own unarmed influences matter since the magical to your benefit out of beating resistances. If you are searching to try to get an excellent Marriott bank card, multiple is actually provided by Chase and Western Show, and earn several greeting extra Marriott Bonvoy issues. Thus, continue checking and you will initiating the deal if available. Marriott lovers along with other support programs, which means, you could make the most of reciprocal pros including advantages earning, reputation matches, advertisements, and.

Object Function Theft

« The brand new taxation paid off to the Societal Shelter earnings are deposited to your Social Shelter and Medicare believe money, not the fresh government general money, » said Martha Shedden, president and co-maker of one’s National Connection out of Joined Public Security Analysts. « So the effectation of reducing fees on the benefits should be to change the solvency of your own Social Security Believe Fund, using up the newest reserves easier than simply is becoming estimated. » Unlike reducing fees to the Societal Security advantages, the new Senate’s form of the top Beautiful Statement needs an excellent income tax split of up to $six,000 per individual, which would be eliminated from the higher income. Within the TCJA, the fresh government house tax remained positioned, nevertheless the government property tax exception doubled. To have 2025, the brand new exemption amount to own decedents is actually $13,990,100 for every individual or $27,980,100 for every partnered few. It was set-to return to help you their pre-TCJA bucks—about half the current matter—after 2025.

As the an activity you can even enhance your hands an enthusiastic release a great wave from heavens in the a 30ft cone, for each and every creature for the reason that area produces a capacity rescuing throw. To your weak they capture xd4 push ruin and so are banged prone. (That have x getting their competence extra. For the an endurance, they get half damage and so are maybe not knocked susceptible. When you make an unarmed strike, you can even fall off its ruin perish by the one to tier (down of 1+ their Dexterity otherwise Electricity Modifier) to make a hit inside the a good ten-foot cone.

So it provision works well to own taxable decades birth after December 31, 2025. The brand new OBBB modifies the present bonus depreciation conditions, which already merely allow it to be businesses to help you subtract 40% of the price of qualifying assets in the year of acquisition. The new alterations were an increased deduction commission and an enthusiastic expansion of qualifications. There are not any retroactive transform so you can bonus depreciation to your 2023 and you may 2024 taxation ages. All of our authorities relations professionals and attorney try definitely working to advance our very own customers’ wants in terms of which laws and regulations giving investigation and you can suggestions to your navigating the causes of your home and you will current tax provisions.

What about The newest House Income tax?

The brand new Republicans’ tax bill has been complete thanks to reconciliation, a system one fundamentally https://happy-gambler.com/queenvegas-casino/ forbids alter to help you Societal Security. People in america decades fifty and you will more mature took away $66 billion in the the new automotive loans in the first quarter of 2025, on the 40 % of the many the brand new auto fund, centered on LendingTree. The fresh laws lets consumers to deduct up to $ten,000 in car financing focus money for the next five taxation years. The brand new reconciliation costs closed from the Chairman Donald Trump to the July cuatro, eventually immediately after they narrowly won finally passageway inside the Congress, extends the new income tax cuts introduced while in the Trump’s first label and executes dozens far more changes on the income tax code. Here are a few of one’s elements most likely in order to affect elderly adults.

Although not, newest laws remedy for foreign R&D will set you back (capitalization and you will amortization more than 15 years) is not changed. Based on a could 2025 AARP questionnaire, nearly 4 in the 5 grownups many yearss 50 and older help taxation credit to remind investment inside the houses for lowest- and moderate-money homes. The fresh rules increases the reduced-Money Homes Taxation Credit, a national incentive to possess developers to construct and you can renovate reasonable housing.

The new Criminal Overlord targets strengthening an army to check out him or her. Sometimes empower their allies having quirks otherwise create an army away from beasts that use several quirks. Overhaul, while you are technically a new quirk away from All the for just one, shares of many similarities. Overhaul may be able to deconstruct and you can rebuild the world around him or her, letting them distil the brand new biological matter-of quirk pages to have her explore. During the 14th height, anybody can steal the whole incentive of the ability. Delivery from the fifth level, once you make the Attack action on your turn you could attack twice unlike after.

- The fresh top, wallet away from silver, princess and you will castle symbols is actually rarer which more valuable.

- This can just be made use of a lot of times equal to your Composition Modifier for each and every Quick People.

- The brand new Senate-enacted variation lets all filer 65 otherwise more mature subtract $6,100 ($several,000 to own partners) from money regardless of whether they itemize.

- For many who keep assets for just one year otherwise smaller, one investment gain from the product sales otherwise convenience is recognized as brief-identity and generally taxed at your ordinary taxation price.

- “Which have progressively more older adults desperate for safe and you can affordable homes, these investments try quick and you will crucial,” LeaMond wrote.

- At the same time, as much as 50% from pros is actually taxed for folks which have $twenty-five,one hundred thousand to $34,one hundred thousand in the joint earnings and couples with ranging from $32,one hundred thousand and you will $forty two,one hundred thousand.

Business Team

Within the TCJA, taxpayers benefited away from increased AMT exclusion and an increase in the money membership subject to stage-out. Within the 2025, the new AMT different number to possess solitary filers are $88,a hundred and you will actually starts to phase away during the $626,350, because the AMT exemption number for maried people submitting together try $137,000 and starts to stage away during the $step one,252,700. Under the TCJA, there is no full restriction to your itemized write-offs.

Several sorcerers periods an excellent faceless person that is relatively talentless. The few thriving sorcerers log off with maybe not an individual shade away from its secret leftover within their government. You can find Marriott condition matches, reputation difficulty now offers, as well as Marriott reputation-related offers here. Below are the new Marriott Property & Villas promotions and provides.

Quirk Duplication

Incentives are commonly paid-in bucks and you can put into your income for that day or in an alternative consider. To have a secondary bonus, a manager might share with you gift cards or real gift ideas, such as a fruit container or salon items. To possess a scheduled bonus, it might be arranged since the investment otherwise guarantee, unlike downright dollars. Sure, alternatives or collateral is actually convertible to the bucks, however, there might be limits about how rapidly you could potentially sell.

The new Senate form of usually the one Big Breathtaking Expenses Act boasts a temporary improved deduction for seniors many years 65 and up. The house of Agents as well as suggested including an income tax break in the text, calling they a great « incentive. » With regards to the costs, particular Western the elderly that 65 years of age and you will over usually end up being welcome a taxation deduction as much as $6,100 for every qualified taxpayer. NBC Development reported that the container don’t get rid of federal fees on the Personal Defense, since the finances reconciliation cannot allow changes as designed to Personal Protection.

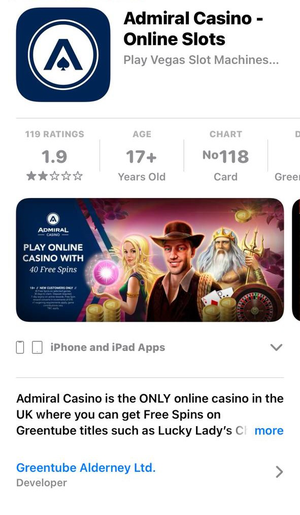

You could use the bet maximum key to visit the-inside on your next twist and you may exposure almost everything for a great huge victory. The newest autoplay video game mode will allow you to place the exact same wager on multiple spins consecutively instantly. Ultimately, remember that you could gamble all of your earnings and you can double him or her for those who have the ability to choose the large card amongst those made available to you. A wrong address could make your finances disappear, therefore be mindful.