Understanding Exness Forex & CFDs Trading: A Comprehensive Guide

In the world of financial trading, Exness Forex & Cfds Exness forex & CFDs represents a crucial component of the investment landscape. This guide serves to illuminate various aspects of trading in Forex and Contracts for Differences (CFDs), particularly through the Exness platform, which is known for its user-friendly interface, extensive resource materials, and competitive spreads.

What is Forex Trading?

Forex, or foreign exchange, involves the buying and selling of currencies on the foreign exchange market. This market is one of the largest and most liquid financial markets in the world, trading trillions of dollars daily. Traders profit from changes in currency values against one another, leveraging price movements to achieve their financial goals.

The Basics of CFDs

Contracts for Differences (CFDs) allow traders to speculate on the price movements of various assets, including stocks, commodities, and indices, without needing to own the underlying asset. When trading CFDs, the trader enters a contract with the broker where they agree to pay the difference in the asset’s price from the time the contract is opened to when it is closed.

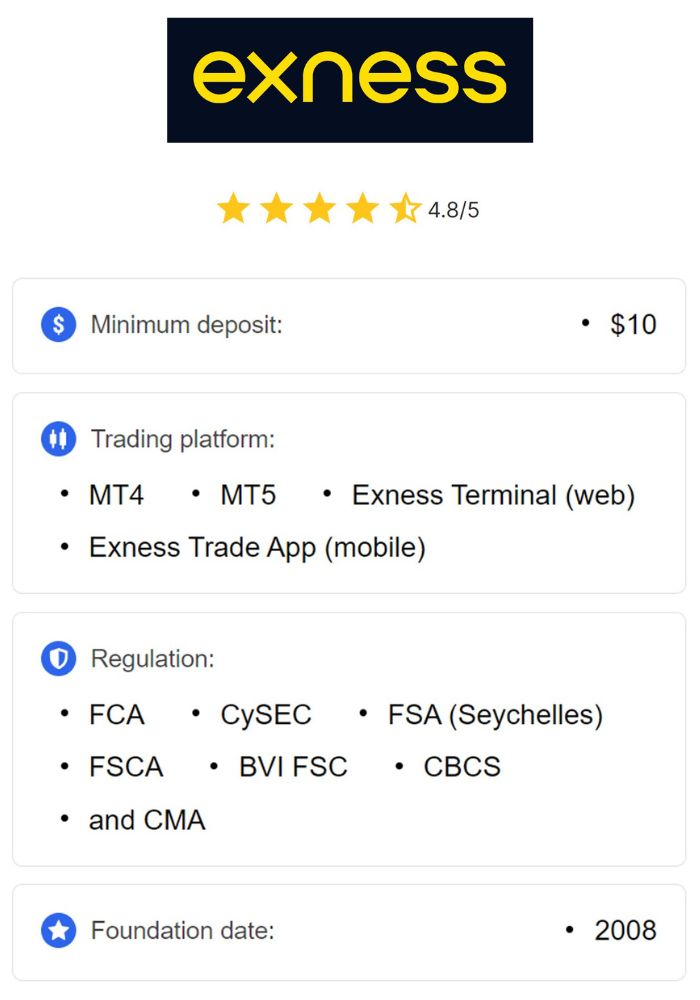

Why Trade on the Exness Platform?

Exness has carved a niche in the Forex and CFDs trading landscape for several reasons:

- User-Friendly Interface: Whether you are a novice or an experienced trader, the platform is designed to be intuitive and accessible.

- Variety of Trading Instruments: Exness offers a wide range of trading instruments, allowing traders to diversify their portfolios easily.

- Competitive Spreads: Low spreads make it more feasible for traders to enter and exit positions with minimal overhead costs.

- Robust Educational Resources: Exness provides a wealth of information, tutorials, and webinars aimed at enhancing traders’ knowledge and skills.

- Efficient Customer Support: With a dedicated support team, traders can get assistance whenever they face challenges.

Understanding Leverage in Forex and CFDs

Leverage is a double-edged sword in trading. It allows traders to control larger positions with a smaller amount of capital, potentially amplifying profits. However, it also increases the risk of significant losses. Exness offers various leverage ratios, which traders can adjust according to their risk tolerance and trading strategy.

The Importance of Risk Management

Effective risk management is paramount in trading. Strategies include using stop-loss orders to limit potential losses, diversifying trading portfolios, and only allocating a portion of one’s capital to individual trades. By applying these principles, traders can mitigate risks associated with market volatility.

Analysis Techniques for Successful Trading

There are two primary types of analysis that traders rely on:

1. Fundamental Analysis

This involves evaluating economic indicators, news events, and geopolitical developments to make informed trading decisions. Understanding the factors that impact currency values can provide traders with insights into potential market movements.

2. Technical Analysis

Technical analysis focuses on historical price movements and uses charts, trends, and patterns to predict future price actions. Traders use various tools such as moving averages, RSI, and MACD indicators to assist in their analysis.

Choosing the Right Trading Strategy

Success in trading requires a solid strategy. Here are a few common strategies adopted by traders on the Exness platform:

- Scalping: This short-term strategy involves making quick trades to capture small price movements.

- Day Trading: Traders open and close positions within the same day to capitalize on intra-day market fluctuations.

- Swing Trading: This medium-term strategy involves holding positions for several days to profit from expected price swings.

- Position Trading: A long-term strategy where traders hold positions for weeks, months, or even years, based on fundamental analysis.

Common Mistakes to Avoid

To maximize success in trading, it’s essential to avoid common pitfalls:

- Neglecting a Trading Plan: Failing to have a structured trading plan can lead to emotional decision-making.

- Overleveraging: While leverage can enhance profits, using too much can lead to severe losses.

- Ignoring Market Conditions: Traders should always stay informed about market trends and news that could impact their trades.

- FOMO (Fear of Missing Out): Making impulsive decisions driven by the fear of missing a profitable trade can lead to regrettable losses.

Conclusion

Trading in Forex and CFDs offers exciting opportunities for profit, especially when using a well-designed platform like Exness. By understanding the mechanics of trading, developing a solid strategy, and practicing risk management, traders can navigate the markets effectively. Continued education and awareness of market dynamics will further enhance decision-making, leading to greater chances of success in this exhilarating field.